Exploring the Benefits of Joining a Destination Credit Union in 2025. Destination credit unions are unique financial institutions that prioritize personalized services, lower fees, and community-driven initiatives. In 2025, they continue to stand out by offering tailored solutions, empowering members with financial education, embracing innovative technologies, and supporting ethical and sustainable practices, making them an ideal alternative to traditional banks.

What Is a Destination Credit Union?

In the financial world, credit unions have long been recognized for their member-focused approach and community-driven services. Among these, destination credit unions stand out as institutions specifically designed to cater to unique communities or niche groups with shared interests, professions, or geographical locations. Unlike traditional banks, which prioritize shareholder profits, destination credit unions emphasize personalized financial solutions, collective benefits, and fostering community relationships.

As we enter 2025, the concept of destination credit unions is becoming increasingly popular, drawing attention from individuals seeking financial stability, community involvement, and innovative services. But what makes joining a destination credit union so advantageous? Let’s explore the key benefits.

Personalized Financial Services

One of the defining features of destination credit unions is their commitment to providing tailored financial solutions. Unlike large financial institutions that operate with a one-size-fits-all approach, destination credit unions understand the unique needs of their members. This personalized service includes customized loan options, competitive interest rates, and financial products designed to address specific community needs.

For example, a destination credit union serving a farming community might offer agricultural loans with flexible terms, while one catering to healthcare professionals could provide specialized savings plans for continuing education. This member-first approach not only simplifies financial management but also ensures that members have access to resources that genuinely align with their goals. (Read More: Best Travel Credit Cards for Points and Perks: A 2024 Guide).

Lower Fees and Better Rates

A standout advantage of destination credit unions is their ability to offer lower fees and better rates compared to traditional banks. Since credit unions are not-for-profit organizations, their primary focus is on benefiting members rather than maximizing profits. As a result, members often enjoy reduced charges for services like checking accounts, wire transfers, and ATM usage. (Read More: Top 10 Best Airline Credit Card Miles Programs to Maximize Your Rewards in 2024).

Additionally, destination credit unions typically offer higher interest rates on savings accounts and lower rates on loans and mortgages. These financial perks make them a smart choice for individuals seeking to grow their wealth while minimizing unnecessary expenses.

Community-Oriented Approach

Joining a destination credit union is more than a financial decision—it’s an opportunity to become part of a close-knit community. These credit unions thrive on fostering strong relationships among members, often organizing events, workshops, and initiatives that benefit the local community. By prioritizing the needs of their members and supporting community projects, destination credit unions create a sense of belonging that is rarely found in larger financial institutions.

For example, some destination credit unions sponsor scholarships for local students, fund environmental conservation efforts, or support small businesses within their community. Members can actively participate in these initiatives, contributing to the growth and well-being of their surroundings.

Enhanced Member Control

Another significant benefit of joining a destination credit union is the level of control members have over the institution. As member-owned entities, credit unions operate democratically, giving each member an equal vote regardless of the size of their account balance. This structure ensures that decisions are made with the collective interests of members in mind. (Read More: Best Airline Credit Card Miles: Unlock Free Flights and Exclusive Perks in 2024).

In 2025, many destination credit unions are leveraging digital platforms to enhance member engagement, allowing for online voting, virtual town halls, and real-time feedback on proposed policies. This transparency and inclusivity empower members to play an active role in shaping the future of their credit union.

Innovative Technology and Services

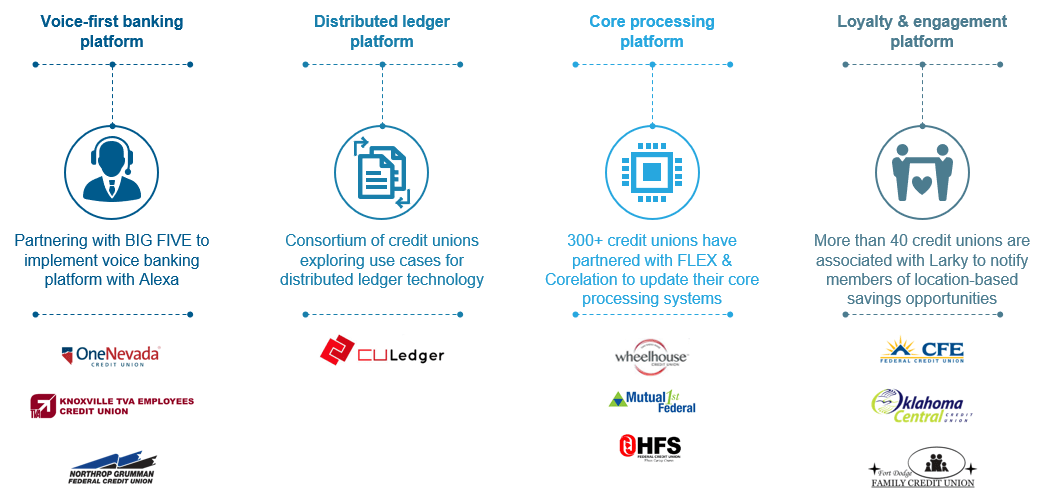

The financial sector is rapidly evolving, and destination credit unions are keeping pace with technological advancements. From mobile banking apps to digital wallets and AI-powered financial planning tools, these institutions are investing in technology to enhance member experience.

In 2025, destination credit unions are expected to lead the way in offering eco-friendly financial solutions, such as paperless transactions and green loans aimed at funding sustainable projects. By combining traditional values with modern innovation, destination credit unions provide members with the best of both worlds.

Financial Education and Empowerment

Financial literacy is a cornerstone of destination credit unions. Unlike traditional banks, which may prioritize selling products, credit unions focus on educating members about managing their finances effectively. They offer workshops, webinars, and one-on-one counseling sessions to help members make informed decisions.

For instance, a destination credit union might provide resources on budgeting, retirement planning, or navigating homeownership. By empowering members with knowledge, these institutions ensure that individuals can achieve long-term financial stability and independence.

Stronger Security and Privacy

In an era where data breaches and cyber threats are becoming increasingly common, destination credit unions are committed to protecting their members’ financial information. These institutions prioritize robust cybersecurity measures, regularly updating their systems and training staff to handle potential threats.

Furthermore, the community-focused nature of destination credit unions means that members are treated as individuals rather than mere account numbers. This personalized approach reduces the likelihood of errors and ensures that concerns are addressed promptly and effectively.

Sustainability and Ethical Practices

For socially conscious individuals, destination credit unions offer an appealing alternative to traditional banks. These institutions often prioritize sustainability and ethical practices, investing in initiatives that align with their members’ values. Whether it’s funding renewable energy projects or supporting local non-profits, destination credit unions are dedicated to making a positive impact on society.

In 2025, more people are seeking financial institutions that reflect their commitment to environmental and social responsibility. By joining a destination credit union, members can contribute to meaningful change while meeting their financial goals.

The Future of Destination Credit Unions

As we look ahead, the role of destination credit unions in the financial landscape is set to expand. With advancements in technology, growing demand for personalized services, and an increased focus on community engagement, these institutions are well-positioned to meet the evolving needs of their members.

In addition to their traditional offerings, destination credit unions are exploring innovative solutions such as cryptocurrency integration, advanced data analytics for personalized recommendations, and partnerships with fintech companies to enhance member experience. These forward-thinking strategies ensure that destination credit unions remain relevant and competitive in a rapidly changing world.

Conclusion article Exploring the Benefits of Joining a Destination Credit Union in 2025

Joining a destination credit union in 2025 offers a host of benefits, from personalized financial services and lower fees to enhanced community involvement and innovative technology. These institutions stand out as beacons of trust, transparency, and member-focused values in an increasingly complex financial environment.

By choosing a destination credit union, individuals can enjoy not only financial stability but also the satisfaction of contributing to a greater cause. Whether you’re seeking tailored solutions, ethical practices, or a sense of belonging, destination credit unions provide a compelling alternative to traditional banks. As the financial world continues to evolve, these member-centric institutions are poised to lead the way, ensuring a brighter and more inclusive future for all.